How Do House Prices Drive Spending?

House prices and spending move together but little is known about the underlying mechanism linking them.

We design a test to discriminate between the housing wealth effect hypothesis and the collateral effect hypothesis. The wealth effect hypothesis says that home owners consider home value changes as windfalls and the collateral effect says that a home value increase generate additional collateral which can be borrowed against. We find that home owners who are close to their collateral borrowing constraint take out new mortgage loans and increase spending when home values go up.

The effect is magnified among fixed rate mortgage borrowers who have an incentive to refinance their loans to lock in a lower market rate. These results show that the collateral effect is important for explaining the link between house prices and spending. They also emphasize the key role of the mortgage market in transforming house price increases into spending and suggest that monetary policy can amplify the link between house prices and consumer spending by affecting interest rates on mortgage loans.

Disagreement over the causes of the link between home values and spending

House prices and spending tend to move in tandem. However, there is disagreement over the causes of this link. One set of studies emphasize the housing wealth effect hypothesis. According to this, an unanticipated change in the home value can affect total life time resources, and this can lead home owners to revise their consumption plans. Campbell and Cocco (2007), Muellbauer (1990), Skinner (1996) find support for this hypothesis. An alternative set of studies emphasize the collateral hypothesis whereby an increase in home values generate additional collateral which home owners can borrow against. Agarwal and Qian (2017), Aron and Muellbauer (2013), Browning et al. (2013), Cooper (2013), Disney and Gathergood (2011), and Leth-Petersen (2010) find evidence in support of this hypothesis, and it is also the explanation emphasized by Mian and Sufi (2011) and Mian, Rao, Sufi (2013) in the context of the recent US housing collapse and mortgage crisis.

A new test to discriminate between the wealth effect and the collateral effect hypotheses

Up to now it has been difficult to perform a direct test of the housing wealth effect hypothesis against the collateral effect hypothesis because data on subjective expectations to home values along with data on mortgage borrowing and spending have been lacking. Identifying unexpected movements in home values is fundamentally a matter of how subjective expectations about home values align with realizations. We collect a new individual level longitudinal data set for about 5,000 Danes covering the period 2011-2014 with subjective expectations to future home values. Our data documents exactly what home owners believe about their wealth, and not what the econometrician believes, and they enable us to calculate subjective unanticipated home value changes. We link this information to high quality third party reported administrative records with information about deposits, financial assets, bank and credit card debt, and detailed information about mortgages and the timing of refinancing decisions. This unique data set enables us to directly test the housing wealth hypothesis against the alternative hypothesis that the association between spending and home values is driven by the loosening of borrowing constraints when prices increase.

Spending responses driven by mortgage borrowing

We find that unanticipated home value gains lead to increased mortgage borrowing. The marginal propensity to increase mortgage debt is 3-5% of unanticipated home value gains. Unanticipated home value losses are not associated with any change in mortgage debt. This pattern is documented in Figure 1. Because we have data for practically the entire budget constraint we can back out the implied spending response which turns out to exhibit the same pattern and the same magnitudes as for mortgage debt growth. The asymmetric response to positive and negative home value changes is indicative that the wealth effect is not likely to be the most relevant explanation. When home owners are entirely unconstrained then spending adjustments should be symmetric for positive and negative price changes. The expected pattern is different when mortgage borrowing constraints are at play. They only bind at the time of loan origination, such that banks do not ask borrowers to pay back the loan more quickly when prices decline. For this reason, when borrowing constraints drive the association between home values and spending we should expect to see an effect only when prices increase. To further support this conclusion, we consider home owners with high and low mortgage loan-to-house value (LTV) ratios separately and find that the response is concentrated on home owners who are close to their borrowing constraint.

Figure 1. Change in mortgage debt against unanticipated home value growth

Notes: The horizontal axis shows annual unanticipated home value growth in the period 2011-2014. The vertical axis shows mortgage debt growth. Mortgage debt growth is derived directly from records reported by mortgage banks. The panel shows a binned scatterplot (red circles) where the bins are defined over equal intervals of the unanticipated home value growth and the size of the circles scaled is by the number of observations in the bins. Regression lines weighted by number of observations are estimated separately for positive and negative home value growth (blue) are overlaid. All variables are normalized on average income during 2008-2010.

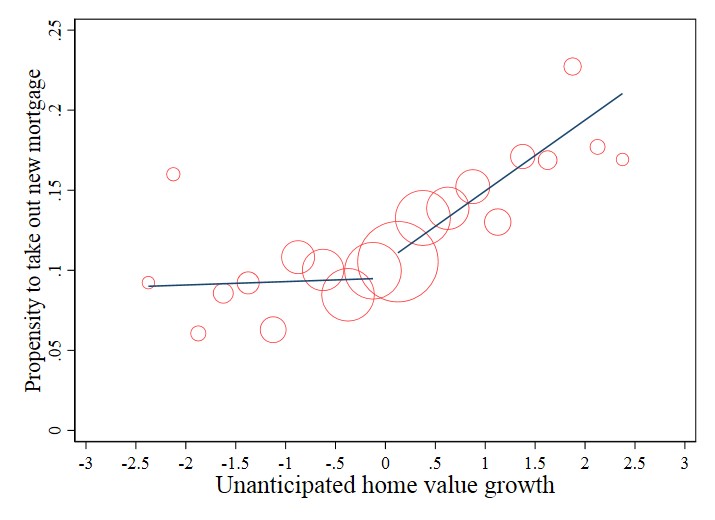

Next, we analyze mortgage borrowing activity directly and find that the effect is driven by home owners who actively take out a new mortgage. This is illustrated in Figure 2 showing the propensity to take out a new mortgage against the magnitude of the unanticipated price change. There is clearly a higher propensity to take out a new mortgage among home owners faced with unanticipated home value increases than among home owners faced with home value falls.

We further find that holders of fixed rate mortgages who are faced with an incentive to refinance to lock in a lower market rate take advantage of this opportunity and extract equity at the same time. This further amplifies the effect of the house price increase on borrowing and spending. These findings point to the importance of the mortgage market in transforming price increases into spending and suggest that monetary policy can play an important role in transforming housing wealth gains into spending by affecting interest rates on mortgage loans.

Figure 2: Propensity to Actively Take Out New Mortgage

Notes: The panel has annual unanticipated home value growth in the period 2011-2014, on the horizontal axis and a dummy variable indicating whether a loan has been refinanced on the vertical axis. The graph shows a binned scatterplot (red circles) where the bins are defined over equal intervals of home value growth and the circles vary in size according to the number of observations in the bins. Regression lines weighted by the number of observations and estimated separately for positive and negative home value growth (blue) are overlaid. The unanticipated home value growth is normalized on average income during 2008-2010

References

Agarwal, Sumit, Wenlan Qian (2017). “Access to Home Equity and Consumption: Evidence from a Policy Experiment.” Review of Economics and Statistics, 99(1), pp. 40-52.

Andersen, Henrik Yde, Søren Leth-Petersen (2019). ”Housing Wealth or Collateral: How Spending and Home Equity Extraction Respond to Unanticipated Housing Wealth Gains”. Forthcoming in Journal of The European Economic Association. Also CEPR DP13926.

Aron, Janine, John Muellbauer (2013). “Wealth, Credit Conditions, and Consumption: Evidence from South Africa.” Review of Income and Wealth, 59, pp. S161-S196.

Browning, Martin, Mette Gørtz, Søren Leth-Petersen (2013). “Housing Wealth and Consumption: A Micro Panel Study.” Economic Journal, 123(563), pp. 401-428.

Campbell, John, Joao Cocco (2007). “How Do House Prices Affect Consumption? Evidence from Micro Data.” Journal of Monetary Economics, 54(3), pp. 591–621.

Disney, Richard, and John Gathergood (2011). “House Price Growth, Collateral Constraints and the Accumulation of Homeowner Debt in the United States.” B.E. Journal of Macroeconomics 11(1), pp. 1-30.

Leth-Petersen, Søren (2010). “Intertemporal Consumption and Credit Constraints: Does Total Expenditure Respond to An Exogenous Shock to Credit?” American Economic Review, 100, pp. 1080-1103.

Muellbauer, John, Anthony Murphy (1990). “Is the UK Balance of Payments Sustainable?” Economic Policy, 5(11), pp. 347-396.

Skinner, Jonathan (1996). “Is Housing Wealth a Side Show?” In D. Wise, ed., Advances in the Economics of Aging, pp. 241–68, Chicago, IL: University of Chicago Press.

Mian, Atif, Amir Sufi (2011). “House prices, Home Equity–based Borrowing, and the US Household Leverage Crisis.” The American Economic Review, 101(5), pp. 2132-2156.

Mian, Atif, Kamalesh Rao, Amir Sufi (2013). “Household Balance Sheets, Consumption, and the Economic Slump.” Quarterly Journal of Economics, 128(4), pp. 1687-1726.

About the authors

Henrik Yde Andersen is Senior Economist at Danmarks Nationalbank

Søren Leth-Petersen is a Professor at the Department of Economics, University of Copenhagen, deputy director of CEBI, Center of Economic Behavior and Inequality and research fellow at CEPR.